When another Venmo user transfers funds to you, the money will arrive in your account instantly. You must sign up for a free Venmo account to send and receive money on the platform. The Venmo app also lets users purchase crypto. You can access your Venmo account using the mobile app or Venmo’s website. Unlike Zelle, Venmo functions as a digital wallet, allowing you to accrue money in your Venmo account to pay for future purchases. Venmo is a social payment app you can use to exchange funds with people and businesses. Zelle doesn’t charge fees to use its service. checking or savings account to use Zelle. Zelle’s technology comes from Early Warning Services LLC, owned by seven major U.S banks: Bank of America, BB&T (now Truist), Capital One, JPMorgan Chase, PNC Bank, U.S. In 2021, Zelle users sent $490 billion-nearly half a trillion dollars-in payments. More than 1,700 banks and credit unions in the U.S. Typically, Zelle capabilities are built into an app from a bank or credit union.

Zelle (rhymes with sell) is a peer-to-peer or person-to-person app that enables you to send money quickly from your bank account to anybody you pick. Nearly 10,000 financial institutions have joined Zelle since its launch in 2017, and 1.8 billion payments were sent through the platform in 2021. There are two ways to use Zelle: through participating banks and credit unions or via the Zelle mobile app.

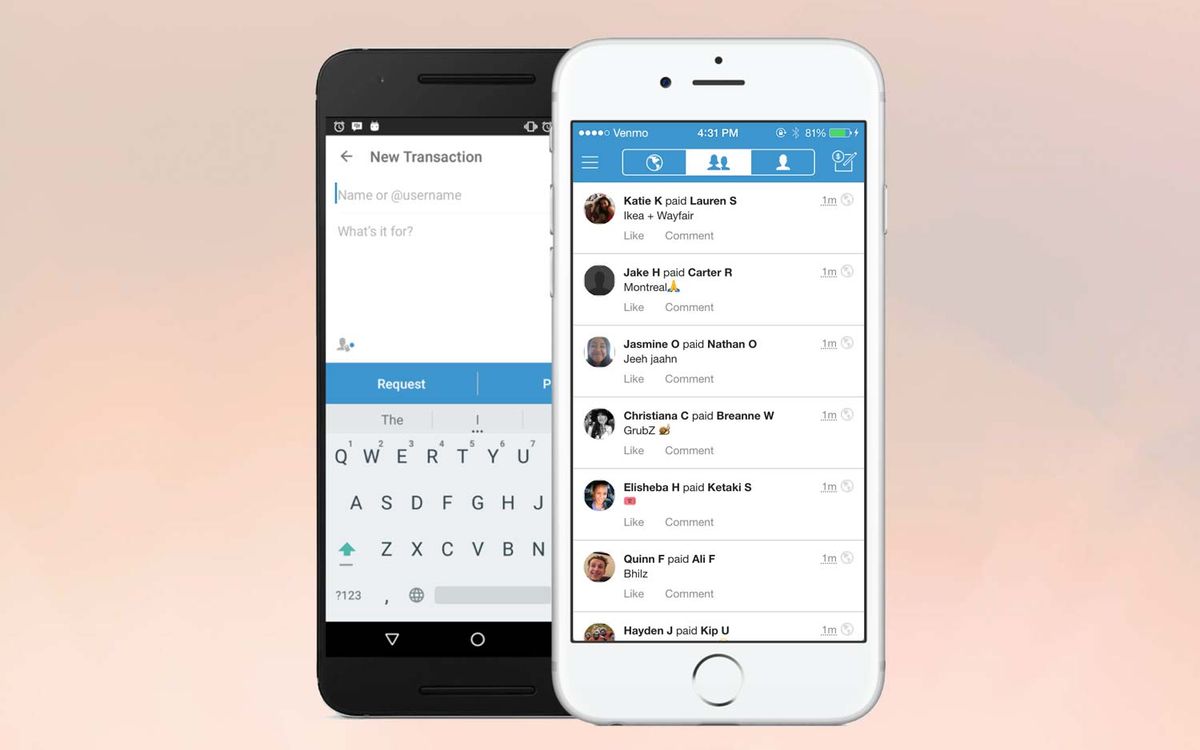

Zelle allows you to send and receive money instantly between U.S. Zelle and Venmo are available only in the U.S., unlike competitor PayPal, which has users in over 200 countries and supports 25 different currencies. Zelle and Venmo are peer-to-peer (P2P) digital payment services that make it easy to do things like split a bill or pay the babysitter. If you often need to send money to or receive it from friends and family, odds are you’re considering Zelle or Venmo to expedite payments.

0 kommentar(er)

0 kommentar(er)